2026 REPORT

The State of AI in

Manufacturing

Benchmark your AI progress and uncover new opportunities.

No time to read now?

The AI Adoption Gap

Benchmark how manufacturing AI is actually progressing and why many organisations lag despite strong interest.

With only 16% of manufacturers currently seeing measurable returns from AI, adoption alone is not the issue — execution is.

This report examines where AI is delivering real operational and commercial impact, and where organisations are struggling to scale beyond isolated pilots.

Inside, you’ll discover:

- Why most AI initiatives stall before reaching enterprise-wide impact

- How Tier 1 leaders like Foxconn, Jabil and Flex are operationalising AI at scale

- Where mid-market manufacturers can close the capability gap

- Why disconnected data remains the biggest barrier to progress

- How AI enables faster decisions, smarter planning and more connected operations

- What truly separates AI leaders from laggards — and why budget is rarely the deciding factor

Designed specifically for contract manufacturers, this report helps you benchmark your organisation’s position on the AI adoption curve against peers and hyper-scale competitors.

It provides a practical framework for assessing capability gaps, prioritising investment, and focusing on the initiatives most likely to drive measurable growth.

INTRODUCTION: THE STATE OF AI IN MANUFACTURING

First, the big picture.

“AI is one of the most profound things we're working on as humanity. It's more profound than fire or electricity,”

Alphabet Inc. CEO, Sundar Pichai

The potential is undeniable.

AI represents one of the most significant operational shifts manufacturing has seen in decades. Analytical AI, Generative AI, and now Agentic AI are working together to drive a 5th Industrial Revolution.

When AI is fully integrated into manufacturing operations - powered by data - the gains can be dramatic:

- 40% increase in labour productivity

- 48% reduction in lead times

- 50% faster new product introductions

- Up to 50% reductions in Scope 1 & 2 emissions

- 30% reduction in material waste

- 25% reduction in energy and water consumption

Source: Global Lighthouse Network, McKinsey

And Accenture projects AI could generate an additional US $3.8 trillion in manufacturing GVA by 2035:

Source: Accenture and Frontier Economics

Source: Accenture and Frontier Economics

But potential and performance are not the same.

While some manufacturers are already seeing a step-change in productivity thanks to AI, it’s not the whole story.

Some businesses are still struggling to extract and connect the data required to train AI models or enable real-time automation. For many smaller firms, the cost of implementation is high, and the path to scale is unclear.

At the same time, concerns about job losses, IP security, and black-box validation are slowing adoption.

THE AI REALITY: WHY PROGRESS IS UNEVEN

Leading manufacturers are pulling ahead

Companies like Jabil, Flex, and Foxconn are leveraging their resources to acquire

AI platforms, attract top talent, and build dedicated engineering teams to integrate AI across their operations.

Increasingly, they are using AI not only to improve efficiency, but to redesign processes and accelerate robotics and agentic initiatives.

Examples from leading global contract manufacturers

.png) |

70+ smart factories

|

|

100,000+ AI-enabled robots $1bn invested in AI and robotics R&D

|

|

|

15% boost in supply chain responsiveness 10% reduction in working capital

|

But AI success is not just for the biggest players

Some mid-market manufacturers are finding focused opportunities to lead, using agility, targeted digital investment and deep domain expertise to deliver fast, measurable impact.

However, most mid-market firms still struggle to build momentum at scale. Skills shortages, data readiness, cultural resistance and unclear ROI continue to trap many organisations

in experimentation.

How wide is the gap?

Research from the WEF puts manufacturing segments way ahead of other verticals in the race to integrate AI, with $10B+ businesses in automotive, aerospace and life sciences benefiting from a considerable head start due to their financial and technical strength.

Source: World Economic Forum

Research by MIT shows that:

-

77% of manufacturers with a revenue of $10 billion or more are currently fully implementing and integrating AI use cases into their processes, compared with 2-4% of mid-market manufacturers.

-

Many mid-market manufacturers (ranging from 43% to 62%) are still in the experimentation phase of their AI journey.

Source: Taking AI to the next level in Manufacturing, MIT

Why progress stalls for the mid-market

Research on Lighthouse companies shows many organisations hit a ‘scaling slump’ as they move from trial use cases to repeatable implementation - but those that power through can unlock significantly higher impact on the other side.

Source: McKinsey

The successful implementation of AI projects can create a virtuous circle of faster and better deployments.

“To move use cases along the development path, it’s important to create teams that bring together AI specialists, business owners, and IT people.”

‘Taking AI to the next level’, MIT study

AI ADOPTION ON THE SHOP FLOOR

In pilot or production - AI is a pivotal part of the new manufacturing eco-system

AI is already live beyond the pilot stage for manufacturers in leading industrial nations around the world.

While adoption spans the whole enterprise, momentum is strongest where decisions are frequent, measurable, and repeatable: on the production line.

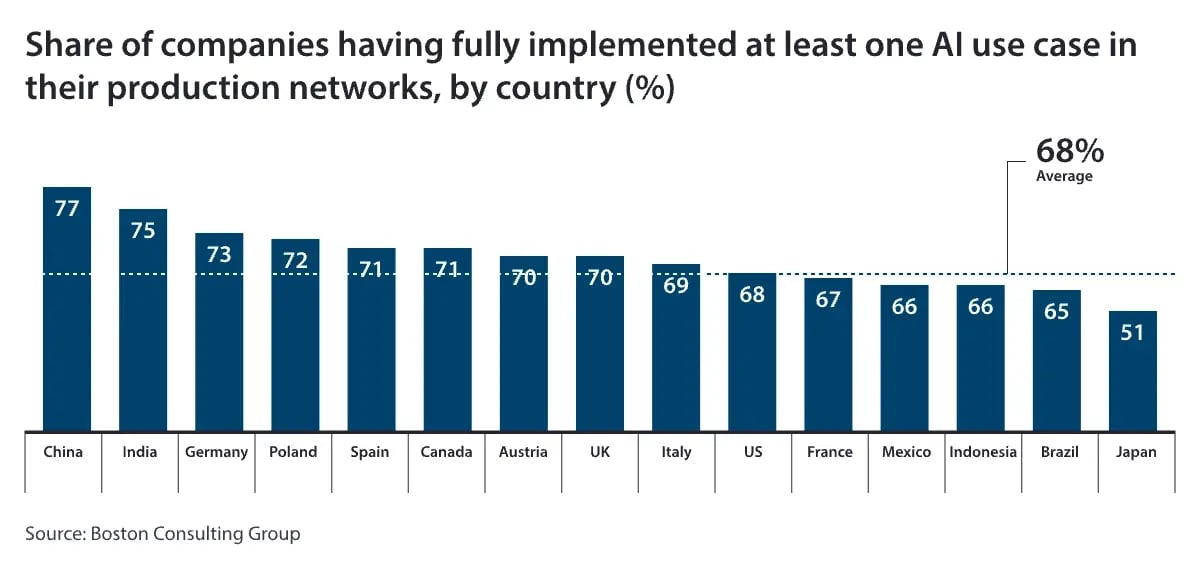

On average, 68% of manufacturers have implemented at least one AI use case in their business - and major international investment in manufacturing AI is set to continue.

Source: Boston Consulting Group

And major international investment in manufacturing AI is set to continue

Source: Boston Consulting Group

Production is where AI has landed fastest

In 2023, production was the dominant focus for AI investment. Automating production lines and shop-floor machinery using AI was the top priority for companies across the US, UK, and Europe.

Source: 2nd Annual State of AI in Manufacturing Survey, Rootstock Software

But the next question is what happens when manufacturers try to scale these early gains, and how emerging technologies are changing what’s possible.

The production paradox: Why shop-floor AI is hard to scale

“Uses in areas like predictive maintenance or defect detection have typically required a lot of tuning and customisation for different scenarios. That’s made it extremely difficult to productionise use cases.”

Pavandeep Kalra, CTO of AI, Microsoft Cloud for Industry

This ‘customisation trap’ has left many manufacturers with promising pilots, but no clear path to scaling. Powerful results, yes. Repeatable ROI? Not so much.

Physical AI: Self-learning robots are changing manufacturing

Physical AI - intelligent, decision-making robots - is poised to become a defining feature of the next manufacturing era.

Many capabilities are expected to become economically viable at scale in the near future, as the World Economic Forum’s mapping of “current” vs “future” robotics suggests:

Some manufacturers are already seeing the impact:

Foxconn applied AI-powered robotics and digital twin simulation to automate high-precision tasks such as screw tightening and cable insertion, previously considered too complex for automation.

Source: WEF Physical AI: Powering the New Age of Industrial Operations

As the cost of Physical AI hardware comes down and the ROI of deploying self-learning robots on the production line becomes more evident, this machinery will become more ubiquitous.

Simplified deployment, such as through virtual training and intuitive interfaces, is significantly reducing time-to-value and expanding accessibility to small and mid-sized manufacturers.

In the future, intelligent robots will continuously adapt to changing conditions and production variables. By analysing data across the factory and supply chain, these systems will optimise quality, reduce defects, and adjust workflows with minimal human input.

However, the mixed picture of success with current AI implementations still persists.

HOW IS AI EVOLVING ACROSS THE MANUFACTURING VALUE CHAIN

In 2024, 17% of manufacturers reported no tangible benefit from their AI deployments. That figure fell year-on-year. But it still highlights a stubborn reality: many AI programmes haven’t yet translated into operational ROI.

Source: 2nd Annual State of AI in Manufacturing Survey, Rootstock Software

Now, that’s starting to shift - both in where manufacturers invest, and what AI is being used to solve.

Rootstock’s 2024 investment data shows spending moving upstream into the value chain: supply chains, inventory optimisation, planning, and resource allocation.

These are areas where better decisions compound - improving service levels, reducing working capital, and stabilising production.

Source: 2nd Annual State of AI in Manufacturing Survey, Rootstock Software

UK manufacturing data from 2024 shows the same direction of travel. AI investment is increasingly focused on connecting legacy machinery with new technology, optimising supply chains, and controlling energy use.

Source: Make UK

Agentic AI helps thread systems and processes together

This shift is being driven by the rise of Agentic AI - tools capable of making goal-directed, data-driven, and autonomous decisions.

Whereas previous AI tools asked:

“How do we make this process faster?”

Agentic systems ask:

“How do we make better decisions across the entire operation?”

The rise of agentic AI promises to be a crucial inflexion point for manufacturers.

BCG's research shows, Agentic AI is transforming investment and deployment patterns in many industries, including manufacturing.

The value of agentic AI is expected to double by 2028

Source: The Widening AI Gap, Boston Consulting Group

McKinsey also forecasts major impact across functions central to growth, from operations and supply chain to commercial performance.

Source: The State of AI in 2025, McKinsey

AI, like most transformative technologies, grows gradually, then arrives suddenly.

Reid Hoffman, cofounder of LinkedIn and Inflection AI, partner at Greylock Partners, and author

In the next section, we look at the people factors that determine whether AI programmes scale.

THE PEOPLE EQUATION: SKILLS, CULTURE AND CAPABILITY

So, what’s holding you back?

Source: Shaking Up the Factory Floor with Digital and AI, BCG

In most organisations, it’s not the promise of the technology - it’s the people and operating model around it.

BCG consistently finds two major barriers: limited AI-skilled personnel and underdeveloped technical infrastructure.

Source: Shaking Up the Factory Floor with Digital and AI, BCG

Rootstock also lists personnel constraints and access to data as key issues for AI adoption, while resistance among leadership and other key stakeholders remained a significant blocker in 2024.

Source: 2nd Annual State of AI in Manufacturing Survey, Rootstock Software

AI success requires strategic co-operation between teams and external partners

AI ROI depends on strategic alignment, cross-functional collaboration, workforce readiness, and cultural adoption.

BCG notes that the principal barriers to realising value from AI are often organisational and skills-based. Like an iceberg, the bulk of implementation challenges lie hidden in the ‘way we do things’, including siloed thinking and resistance to change.

Source: BCG Build for the Future 2025 Global Study

The AI confidence gap

Not every manufacturing business believes it has the expertise to adopt AI effectively.

Source: Make UK

In early 2025, McKinsey identified a serious divide between leadership and employees in their use and expectations of GenAI at work. Their research found:

- 94% of employees were already using Gen AI tools in some capacity.

- Employees were 3x more likely to be using AI daily than leaders realise.

- 47% of employees believed over 30% of their work would be AI-assisted within a year.

- Nearly half of employees wanted formal AI training, but many reported receiving no support at all.

Excitement - and trepidation - on the frontline

As some leaders struggled to define and communicate long-term AI strategy in 2024, sentiment across the EMS sector reflects a mix of optimism and anxiety:

Source: Bytesnap 2024

External analysis also points to long-run displacement risk. The Tony Blair Institute predicts significant job displacement effects over time.

AI could displace between 1m and 3m private sector jobs in the UK by 2050

But will AI be a net destroyer of manufacturing jobs?

Concerns remain, but the narrative is increasingly shifting from replacement to augmentation.

Source: MIT

This signals a fundamental shift in perception from threat to opportunity.

The manufacturing industry needs to reskill

Manufacturers increasingly recognise that unlocking AI’s full potential requires investment in training and digital fluency. Skills shortages persist, and are now becoming more AI-specific:

Source: Barclay’s Research

This underlines a broader structural issue: longstanding manufacturing skills shortages haven’t disappeared. They’ve evolved, with gaps now showing up in areas like data literacy, AI oversight, model governance, and process redesign.

In the US, Deloitte’s Digital Skills Report (2024) found that only 27% of manufacturers currently offer formal AI training programmes, suggesting a wide gap between ambition and readiness.

As one respondent in the MIT study noted:

“The challenge isn’t whether AI can work - it’s whether our people are ready for it.”

Respondent in MIT study

Building human-AI collaboration

AI is reshaping - not replacing - manufacturing roles. It’s elevating maintenance engineers into data-driven problem-solvers, planners into scenario modellers, and procurement teams into strategic risk managers.

“It is in collaboration between people and algorithms that incredible scientific progress lies over the next few decades.”

Demis Hassabis, cofounder and CEO of Google DeepMind

Next, we explore the data foundations that separate pilot success from scalable AI, and how to move forward without waiting for ‘perfect’ data.

DATA: THE CRITICAL ENABLER OF AI PERFORMANCE

Without integration between production systems and enterprise platforms - such as ERP, CRM, procurement, or quality management - AI struggles to drive broader commercial transformation. For most manufacturers, this integration has yet to become reality, so insights often stop where the factory floor ends.

KPMG’s 2025 case study reflects the pattern: ROI from factory-floor implementations is already emerging.

But as Martin Kaestner, KPMG’s Technology Lead for Industrial Manufacturing, points out;

The true potential of AI is realised when data from disparate systems, such as customer relationship management and procurement platforms, is aggregated and analysed holistically.

Martin Kaestner, Technology Lead, KPMG

Where that connection isn’t in place, manufacturers end up with pockets of intelligence rather than enterprise transformation.

Predictions about maintenance or yield don’t inform procurement strategies. Customer feedback doesn’t shape design or business development decisions in real time.

As Carmelo Mariano, Industrial Manufacturer Leader at KPMG, puts it:

“Manufacturers need to combine what they do best (manufacture physical products) with what digital does best (collect real-time data and embed AI) to differentiate their products and gain a competitive advantage. It will not be enough to add digital functionality to machines - a complete reimagination is needed.”

Carmelo Mariano, Industrial Manufacturer Leader, KPMG

But the complete reimagination of the manufacturing process thanks to AI may be closer than many think.

The long-term perspective: Data will be the differentiator

Rootstock’s research found that manufacturers see the greatest long-term impact of AI coming from the various systems that underpin core business functions - from supply chain and ERP to CRM and PLM.

Source: Rootstock

These systems hold the operational intelligence AI needs to deliver real value. Unlocking that value requires connecting them so AI can access, interpret, and act on the data.

The biggest barrier - and the biggest opportunity

Manufacturers are finally taking lack of data integration seriously, but many remain cautious about the quality and quantity of data available in the short term.

As highlighted in the MIT & McKinsey joint research, what separates manufacturers leading in AI from ‘laggard companies’ is not the volume of data they collect - but how effectively they manage, connect, and use it.

“The foundation of effective decision-making lies in data integrity and accuracy. Leaders invest in systems to ensure data is well maintained and available across the organisation.”

MIT/McKinsey, 2025 (page 20–21)

In contrast, lagging firms are held back by:

- Fragmented systems

- Incomplete or low-quality data

- Inability to access data in real time

These barriers are consistent across mid- and large-scale manufacturers, but the impact is disproportionately higher for mid-market firms.

Your data doesn’t have to be perfect

One of the most persistent myths is that manufacturers need clean, structured, enterprise-wide data to get started. That’s simply not true.

According to MIT & McKinsey, many of the most successful AI adopters start small - using just enough good-quality data to support a meaningful data-driven use case.

“If you wait to have perfect data, you’ll probably never get started.”

Philippe Rambach, Chief AI Officer, Schneider Electric

In fact, some mid-sized firms report they have higher rates of AI-suitable data than their $10B+ counterparts, likely due to simpler, more modern digital estates with fewer legacy systems.

Source: MIT Survey

This flips the assumption that scale equals readiness. For many manufacturers, the path to value may be shorter than expected.

The rise of accessible AI

As Pavandeep Kalra of Microsoft notes:

“The skills required to use LLMs are not at the level of data scientists or engineers.”

LLMs, paired with retrieval-augmented generation (RAG), can now extract insight from inspection logs, SOPs, maintenance records and emails to power analytic, predictive and agentic solutions.

But the best-performing companies aren’t chasing perfection - they’re aligning data work to strategic business cases, and cleaning data where it matters most.

“Our approach is to accelerate some data cleaning work when we’ve identified a big AI business case.”

Philippe Rambach

To achieve this, manufacturers need the right people and partnerships in place - to help identify the most valuable data, ensure its quality, and align it across systems in a way AI can act on effectively.

Partnerships will prove crucial to access and integrate data

The BCG found that businesses adopting agentic AI tools, for example, needed to work with partners in a different way to achieve the desired results. Their research showed that most successful AI implementations involved strategic partnerships rather than in-house builds:

Organisations that successfully cross the GenAI Divide approach AI procurement differently, they act like BPO clients, not SaaS customers. They demand deep customisation, drive adoption from the front lines, and hold vendors accountable to business metrics. The most successful buyers understand that crossing the divide requires partnership, not just purchase.

Manufacturers who collaborate deeply with external partners to operationalise data integration are more likely to see outsized gains.

Next, we look at how connected data and accessible AI can unlock growth at the commercial front end, in sales and marketing.

AI BEYOND OPERATIONS: THE UNTAPPED POTENTIAL IN SALES & MARKETING

AI in sales and marketing - unexplored potential for growth

Source: Rootstock

Traditional manufacturers have underinvested in integrated digital marketing and lead generation strategies, relying instead on long-established sales networks, RFQs and referrals to fuel their pipelines.

As a result, many sales and marketing teams have built their process separately from core operational systems.

Data remains scattered across CRM, ERP and customer touchpoints, depriving teams of the insights needed for advanced TAM analysis, demand generation and effective

pipeline nurturing.

According to the Content Marketing Institute, most manufacturing marketers are using AI in an ad-hoc and unsystematic way:

Souce: CMI 2025

Not only this, but just under 50% of respondents to the CMI survey said their marketing success was now limited by their access to data - and the difficulties of automating marketing activity to support complex buyer journeys.

AI is helping unlock and unify siloed operational and commercial data, revealing patterns, signals and opportunities that were previously impossible to see. AI agents are also making it possible for marketing messages to be delivered and customised for individuals in real time, depending on their needs.

Lack of data and AI integration impacts opportunities for growth

However, most manufacturing marketing tech stacks still lack the integrated data foundation required for effective AI.

Source: CMI

For contract manufacturers, this represents a pivotal moment. It is the chance to build an integrated, data-driven commercial function that uses AI not as an add-on but as a true force multiplier for sustainable growth.

CONCLUSION: BENCHMARKING FOR ADVANTAGE

This report highlights a manufacturing sector at a turning point. The gap between AI leaders and laggards is growing, but it is not unbridgeable.

Some manufacturers are already delivering double-digit gains in productivity, efficiency, and responsiveness by embedding AI into their operations and connecting data across the business. Large-scale companies, with the resources to implement robotics and advanced analytics at scale, are transforming their production models and pulling ahead.

But the advantage is not locked in. Mid-market and contract manufacturers can still accelerate value by strengthening data integration, building targeted capabilities, and choosing the right partners. By connecting information across ERP, supply chain, sales and CRM systems, they can serve customers better, uncover new opportunities, and plan more effectively for the future, while laying a foundation for improved operational efficiency.

Technologies such as Custom GPTs and AI agents are making this shift more accessible, automating workflows, generating insights, and connecting processes across the organisation. As confidence grows and early successes build, manufacturers will be better positioned to increase AI investment, upgrade machinery, and embed intelligence more widely.

Those who treat AI as a driver of smarter decisions, more agile operations, and predictive planning will set the pace for industrial growth. In 2026 and beyond, competitive advantage will not depend on who holds the most data, but on who can connect and apply it

most effectively.

The future belongs to manufacturers who:

- Build data-ready infrastructure and choose the right partners

- Empower their teams with AI fluency and practical tools

- Move beyond pilots and scale AI across functions

- Integrate intelligence into every layer of the business

The next benchmark for success is not scale, but smart, connected execution.

AI Resources:

We will send a copy direct to your inbox.